Emmanuel Martinez • Oct 23, 2020

Future of the Markets and Economy for Both Election Outcomes

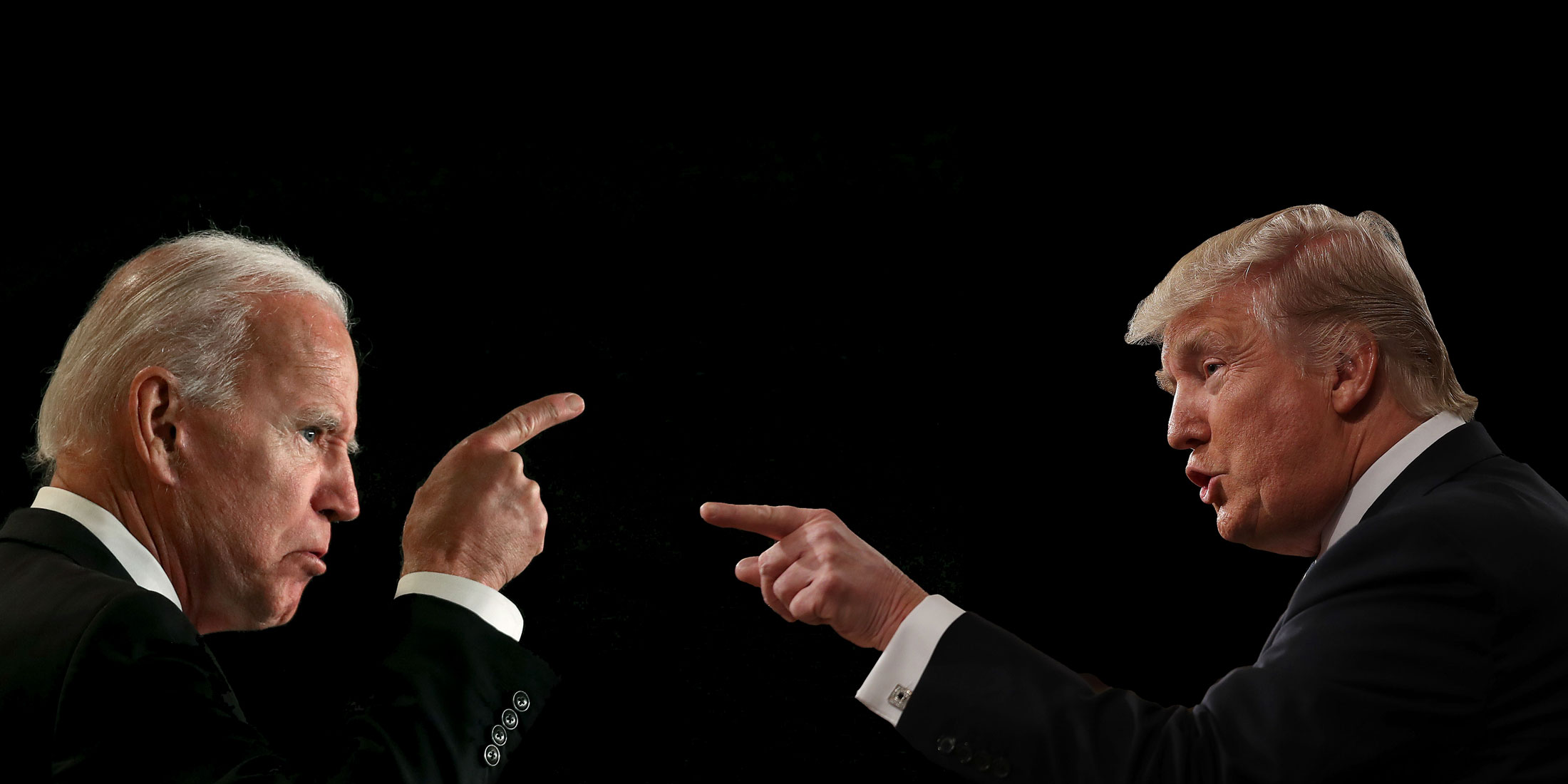

With the election tomorrow, it has become the biggest factor next to COVID-19 affecting the stock market. Regardless of what preference you have politically and who you are going to vote for, as an investor you must have an investment strategy in place that prepares for both scenarios. As we have already experienced a Trump administration and what that would mean to the markets, our focus should be on what a Biden-Harris administration would mean to the stock-market and economy and in what areas it would differ from President Trumps America. There are many industries that would thrive under a Biden administration and many that will significantly underperform. The question that we must ask is which companies and industries will overperform no matter who wins. Let us first look at how they both differ in taxes and then see how the markets and economy would differ in a Biden-Harris administration.

Capital Gains Tax Hike Effect

The Biden-Harris administrations plan to hike the capital gains tax would most likely trigger a sell-off in the stock market as it would give many institutional and high net worth investors a reason to sell and pay capital gains this year than wait for the possibility of having to pay significantly higher in taxes in a year or two. The longer lasting effects of this tax hike will be less money in the stock market in the future as investors, traders, and shareholders that sell at a profit will have less money to buy in again after paying higher taxes. This will in turn lead to lower stock prices.

Corporate and Foreign Tax Hike Effect

Historically, the biggest factor that affects stock prices is company earnings. Mr. Biden’s tax plan to increase the corporate tax rate from 21% to 28%, an increase of 33.33%, will significantly hit companies bottom-lines. Bidens tax plan also proposes to increase taxes on foreign income. Some of the companies that will be affected the most by a foreign tax-hike is big-tech and the S&P 500 leaders this year so far. According to FactSet estimates the tech sector attains around 43.5% of its revenues from the United States, compared to 60.3% from the entire S&P 500. Bank of America analysts found that information-technology, communication-services, and consumer-discretionary sectors would see double-digit declines on their earnings if Joe Bidens tax plan comes to affect.

Energy Sector

The Energy Sector is where we might see the biggest shock as both candidates have opposite positions on climate. If Biden wins, he has emphasized how he will end fossil fuels and subsidize renewable energy. He will also impose fuel-economy standards which will obligate automakers toward European emission standards. On the other hand, President Trump’s policies have focused on deregulating utilities’ carbon emissions and expanding drilling for oil and gas. President Trump is not a renewable energy oppositionist, but he does not favor heavily regulating fossil fuels and emissions as it will displace many jobs in the energy sector. Electric car, solar, and renewable energy will surely outperform in a Biden presidency while oil, gas, other fossil fuels, and traditional automakers will most likely underperform. Exceptions to this might be huge and established pipeline operators who have grown their market share by growing at whatever cost in the last decades. In a Biden presidency new pipelines will slow down dramatically which will just make the barrier to entry into the pipeline operating business larger and will also allow these large and established companies to employ their free cash flows into buying back shares and repaying debt instead of opening new pipelines. Weak players exiting the industry will also allow large players to have better profit margins.

Exodus from high tax states

In a Biden-Harris administration we might see an acceleration in the Exodus of corporations and people from New York, California, and New Jersey into other States. According to calculations from Jared Walczak of the Tax Foundation, top-earners In California could face a state and federal tax rate as high as 62.6% under the Biden plan, a little over 60% in Ney Jersey, and in New York State top-earners could be paying 58.2%. In New York City (where most high earners live) however, when city taxes are added, top earners would be paying over 62%. With Texas (population average growth rate of 1.74% in the last 9 years according to Population USA) and Florida (population average growth rate of 1.59% in the last 9 years according to Population USA) having great employment incentives, no income-taxes, and a lower cost of living, we might continue to see an exodus of top earners and corporations move to these states.

Cannabis

Biden and Harris have both emphasized that they will legalize marijuana federally. If this where to happen, cannabis companies would boom. This would significantly improve the logistics of the entire industry. Some of the problems that many of these companies have been facing is dealing with the distribution and not being able to transport marijuana across states lines. This has caused many supply shortages and a non-optimal distribution chain which would be easily fixed if it were federally legal and allow pot companies to expand and become profitable.

Infrastructure

Infrastructure might be one of the places where both Biden and Trump agree on; they both want a HUGE Infrastructure deal passed. The Biden campaign proposes a $1.3 trillion bill while the Trump administration has proposed a $1 trillion investment plan which would focus on utilizing the private sector. Although both of their proposals differ, as Biden wants to focus on climate change, while Trump and republicans oppose it, there will be players who will greatly benefit no matter who passes the bill. These winners will be 5G stocks, railroad companies, and construction companies.

China

China might be one of the biggest factors in the long-term economic outlook for the United States. Although Biden has said that he will be tough on China, he will most likely not be as tough on them as Trump. If tariffs and tensions are eased in a Biden presidency, American companies that have suppliers and manufacturers in China will benefit while domestic manufacturers will see hits on their bottom-lines. This can economically hit the country in the long-term as many jobs will get shipped out of the United States because of the higher cost of labor compared to places like China.

Minimum Wage

Another factor that could ship jobs out of the U.S.A is the proposed $15 minimum wage by 2025 which Biden wants to get passed. A $15 minimum wage would raise the cost of labor and according to the Congressional Budget Office, the economy could see a loss of 1.3 million jobs. This would more than anything hurt small businesses which can not afford to pay a $15 federal minimum wage. Large corporations like Walmart and Amazon, who have already begun or pledged to have a $15 federal minimum wage, will greatly benefit from this as it will drive many smaller competitors out of business. Trump argues that the minimum wage should be left to the states as the cost of living varies significantly between them.